The latest USA spending data for Q1–Q3 shows a decisive shift in the government’s buying behavior—and if you sell to federal agencies, the window to capitalize is already opening.

Quarter-by-Quarter Spending Shift

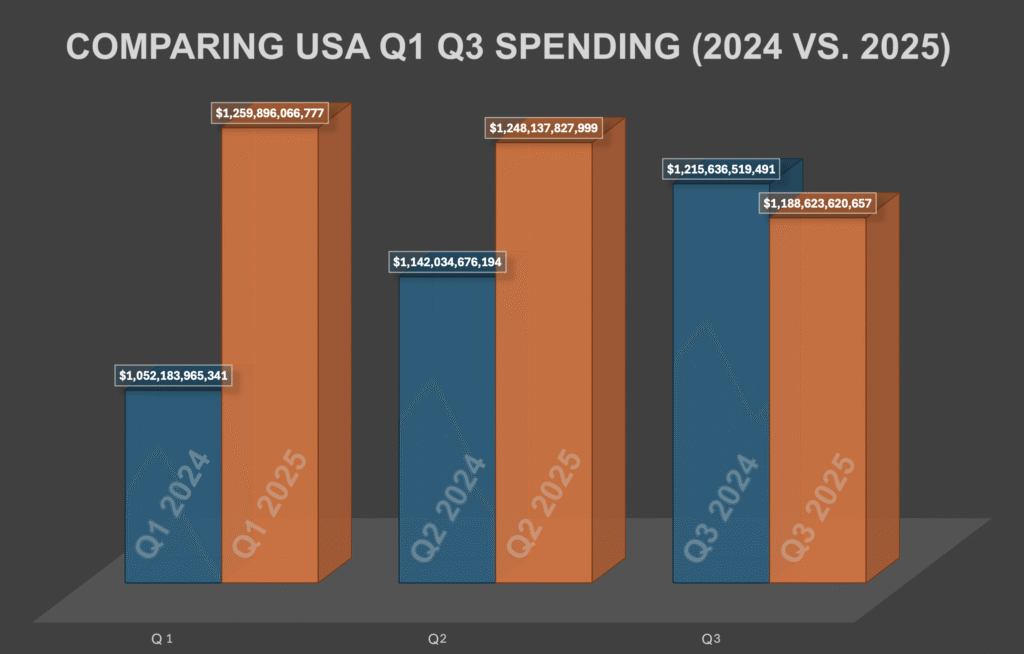

- Q1 2024 → Q1 2025: $1.05T to $1.26T (+20%) — The single biggest Q1 increase in recent years, indicating agencies are front-loading major contract awards.

- Q2 2024 → Q2 2025: $1.14T to $1.25T (+9%) — Strong, steady growth in mid-year obligations.

- Q3 2024 → Q3 2025: $1.215T to $1.188T (–2%) — A slight pullback, likely from delayed appropriations or pre-election spending restraint.

What’s Driving the Trend?

- Accelerated funding releases tied to multi-year infrastructure, defense, and technology modernization projects.

- Election-year dynamics, with agencies locking in obligations early to avoid Q4 uncertainty.

- Possible shifts in discretionary funding, impacting non-defense civilian agency budgets in Q3.

Contractor Takeaways

- Strike Early – With a Q1 surge this large, many FY25 awards are being initiated as early as October–December 2024. Begin positioning 3–6 months before fiscal year start.

- Target Fast-Moving Agencies – Historically, DoD, VA, and DHS show strong Q1–Q2 obligation patterns.

- Monitor Q3 Slowdown Risks – Focus on IDIQs and multi-year contracts that aren’t subject to short-term budget swings.

- Lean Into Infrastructure & Tech – These sectors are driving much of the growth, from cybersecurity upgrades to facility modernization.

Bottom Line

The 2025 spending curve rewards proactive contractors who treat Q1 as the prime hunting season—not the warm-up lap. Align your BD calendar now, and you can ride the early-year surge before the budget waters get choppier.